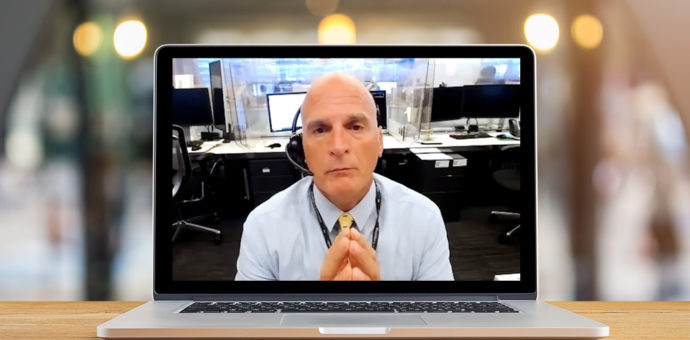

In Bloomberg’s Mike McGlone’s assessment, the capital outflow from the United States to Canada (including money from the asset management Ark Invest), especially for investments in institutional cryptoasset products, may bring forward the approval of a bitcoin ETF. “That could happen by the end of October”, he said in an interview with Stansberry Investor.

The U.S. endorsement of a bitcoin ETF could lead to a further bullish run in the price by providing more confidence for investors with a more conservative profile. McGlone pointed out that the bitcoin ETF would possibly be a futures-backed product but would still open a “legitimate window for capital inflows”.

In his view, this could lead bitcoin to reach US$ 100,000 later this year, confirming data from the latest Bloomberg Intelligence report.

Brazil already offers funds with exposure to cryptoassets

In addition to HASH11, which began trading in April, on July 13, Hashdex announced the launch of a new ETF, the Hashdex Nasdaq Bitcoin Reference Price Index Fund (BITH11), with 100% exposure to bitcoin.

Also, in July, CVM – Securities Exchange Commission, approved the first Ether ETF (ETH) in Latin America of QR Asset Management, operating under ticker QETH11. In the world, only Canada already had a fund in ETH.