Could ether (ETH) become deflationary like bitcoin? According to Transfero blockchain specialist Solange Gueiros, the currency was created to be a fuel (known as a gas fee) for smart contracts, the computing power needed for the network and its storage. However, the recently approved improvement projects for the Ethereum network foresee that some of these fees can be burned, which, in theory, would cause the ether to become deflationary.

It is worth remembering that one of the peculiarities of ether (ETH) is that, unlike bitcoin, there is no limited quantity forecast. Its issuance is constant; that is, on each block is generated new cryptocurrencies. On the other hand, bitcoin expects the issuance of 21 million units.

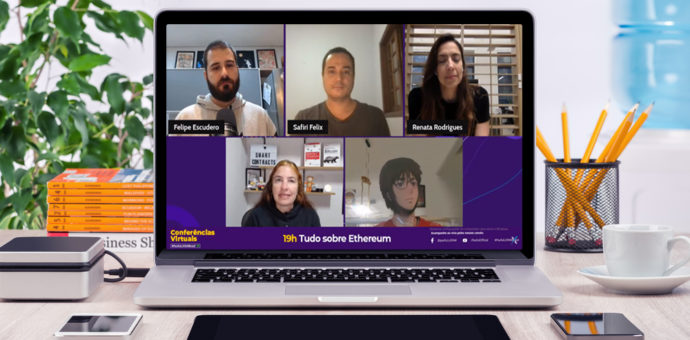

This topic was the subject of debate during the Paxful exchange’s Virtual Conference, which took place on May 12. The co-founder of Paradigma Education, Felipe Sant’Ana, explained that the EIP1559 change will burn ethers of the circulating supply proportionally to the demand for gas. According to him, this would be a “difficulty bomb”, which is a strategy to make the protocol more challenging.

Ether values innovation

“Bitcoin is extremely conservative, but ether values innovation. Each path has its pros and cons. In bitcoin, the governance is slower. In Ethereum, things change faster, and its monetary policy is subject to democratic groups”, Felipe added, mentioning that ether, unlike bitcoin, has no halving but updates that bring hardships.

However, in the view of Transfero’s director of products and partnerships, Safiri Felix, ether is unlikely to break out as much from bitcoin – but it’s not impossible. “The bullish move is ether’s own agenda, which carries changes in its fundamentals”, he said. “Ethereum is Ethereum and bitcoin is bitcoin. They are different proposals. Bitcoin is born as a scarce digital commodity, and Ethereum is a commodity that has stood out for its utility. I don’t see ether as a monetary category”, he stressed.

DeFi Bubble

The event also discussed a possible ‘bubble’ emerging with the decentralized finance (DeFi). In Safiri’s assessment, DeFi is interesting because it can capture transaction values and be immune to censorship and be decentralized. However, he points out that caution is needed. “It is premature to talk about a bubble, we will have increasingly interesting applications. But you have to be careful with excesses.”

The Paxful Conference also discussed digital scams and security, aiming to alert the public about the issue. “Currently, the low interest in Brazil leads people to seek other sources of passive income. But it is necessary to be very careful with frauds or unrealistic promises of profit”, said the lawyer specialized in the segment, Artêmio Picanço.

According to the expert, every second, there are 15 attempts at digital scams in Brazil. “Crimes are becoming increasingly sophisticated; criminals create a narrative of apparent credibility, promising significant gains. And people’s lack of financial education ends up leading to misconceptions that enables scams”, he said. “Those who want to invest need to learn how to do the math and stop believing in ‘magical’ gains. The investor should be suspicious about promises that are out of reality, financial pyramids, and other irregularities.