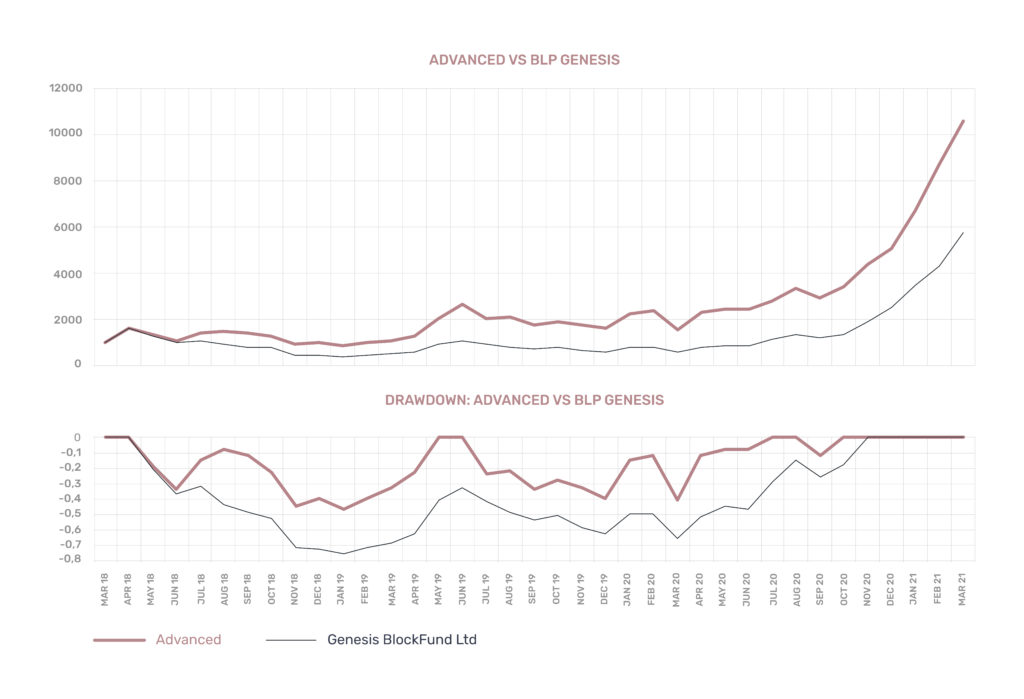

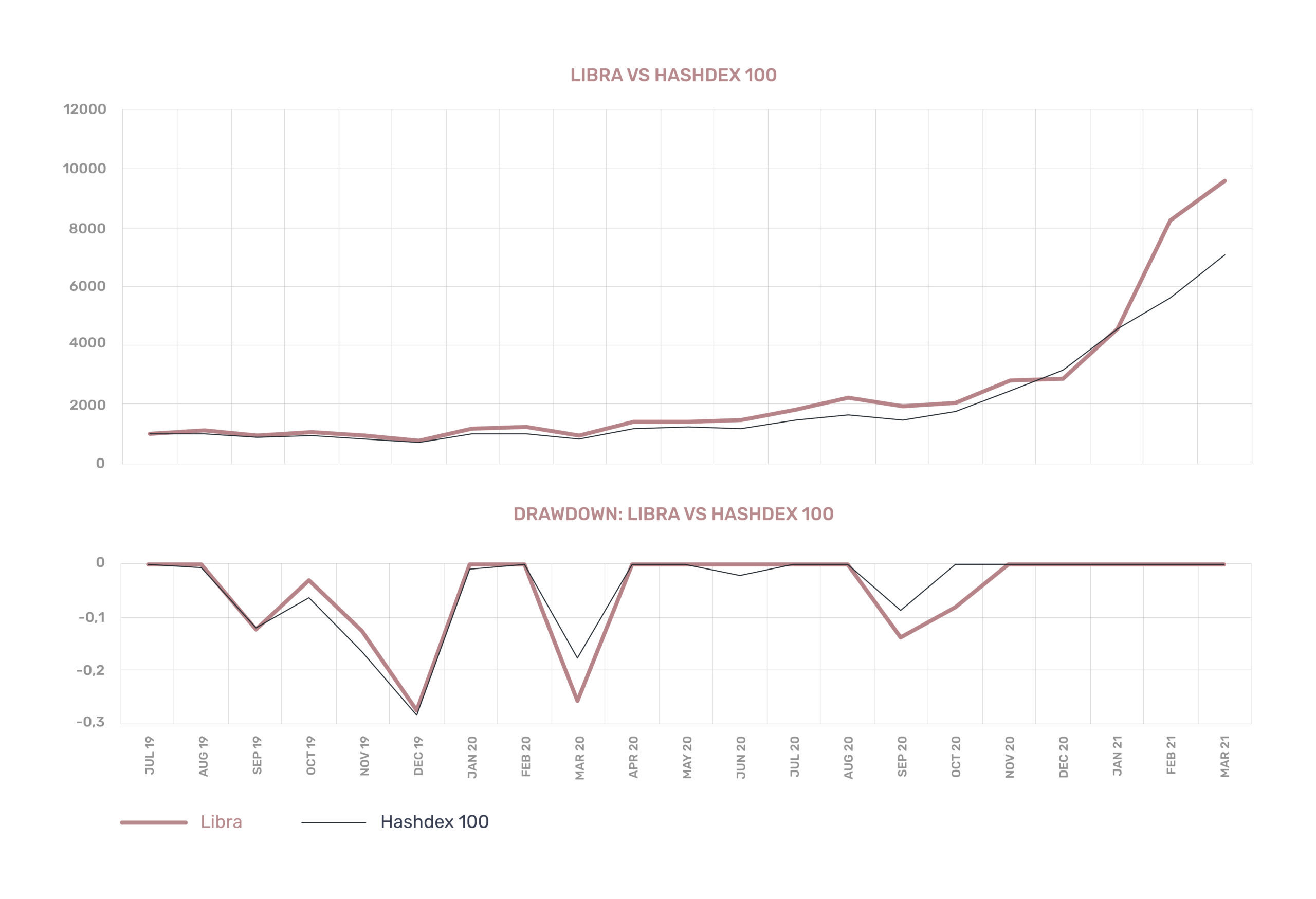

Over the period from April 2018 to March 2021, BLP’s managed investment fund, the Genesis Block Fund, earned a return of 472% (78% annualized). Its maximum drawdown – an indicator of peak-to-trough decline – was 75%. On the other hand, the Hashdex 100 fund, which replicates the Nasdaq Crypto Index (NCI) earned 607% (223% annualized) returns between July 2019 and March 2021.

The analysis is from Transfero’s Head of Asset Management, Lucas Xisto, who compared both funds with the performance of two of the company’s managed wallets, Advanced and Libra. “Transfero’s managed wallets maintain a good performance when compared to the Brazilian digital asset investment fund market”, he evaluated.

NCI is an index developed by the Brazilian asset management Hashdex in partnership with Nasdaq to represent the crypto asset market. The Genesis Block Fund aims to invest in a diversified portfolio of digital assets, emphasizing the largest protocols and surpassing the Bloomberg Galaxy Crypto Index (BGCI).

Advanced and Libra show good performance

According to the expert, in the same analysis period of the Genesis Block Fund, Advanced presented less risk, with a maximum drawdown of 46%. The return was 956% (119% annualized).

Lucas explains that the Advanced wallet uses the most various decision support tools, with fundamentalist and quantitative investment methodologies. “We prospect the most promising projects in the digital asset universe and jointly use tools that detect inefficiencies in this market that never sleeps”, he said.

Conversely, the Libra wallet is passive, exposed to the digital asset market, as is the Hashdex 100. Considering the same time window used to analyze the investment fund, Libra obtained a return of 859% (288% annualized). “The outcome comes from the proposal for a periodic rebalancing of the 10 cryptocurrencies with the highest capitalization in the market, according to data from CoinMarketCap”, he said.