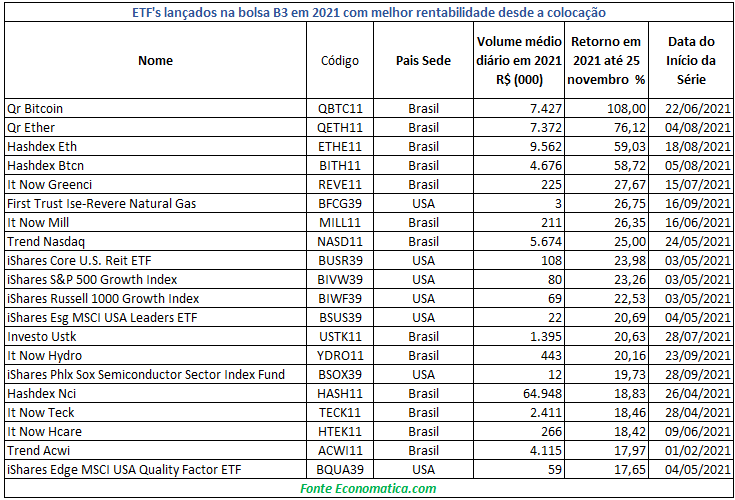

Cryptoassets continue as a highlight in the financial market with the launch of ETFs in 2021. For the first time in history, bitcoin was formally traded in investment funds through stock exchanges in Brazil.

In addition to debuting on B3, cryptoasset stocks recorded the highest returns among ETFs traded. According to a survey by Economatica, funds with exposure to bitcoin and ethereum had returns of up to 108%.

In the ranking presented by Economatica, cryptoassets appear in the top four places on the list, with valuations between 58.72% and 108%, considering that survey took into account data until November 25, 2021.

ETFs with cryptoassets on the stock market (Reproduction/Economatica)

The first place on the list belongs to the QR Bitcoin fund (QBTC11), created by QR Capital. In total, this ETF had a cumulative appreciation of 108% in the first eleven months of 2021, with 100% exposure in bitcoin.

Also created by QR Capital, QR Ether (QETH11) is the second most profitable ETF of the year. With a 76.12% return, this investment fund was launched on August 4, 2021, and has 100% exposure to ether (ETH).

In third place in the ranking is Hashdex ETH (ETHE11), with a return of 59.03%. With 100% exposure to ETH, this ETF was launched on August 18, 2021.

Another Hashdex ETF on B3’s list of best returns is Hashdex Btcs (BITH11). In fourth place in the ranking, the BITH11 has appreciated 58.72% through November 25.

Besides being the best performers among the ETFs listed on the Brazilian stock exchange, the cryptoasset funds have one thing in common: they were all launched in 2021.

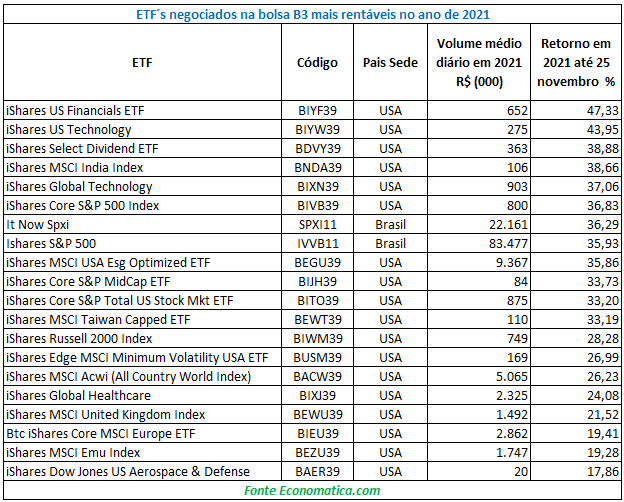

Economatica’s research brings data on other ETFs, but none of them had higher profitability than bitcoin and ether funds traded on B3, even considering international ETFs; check out the table: