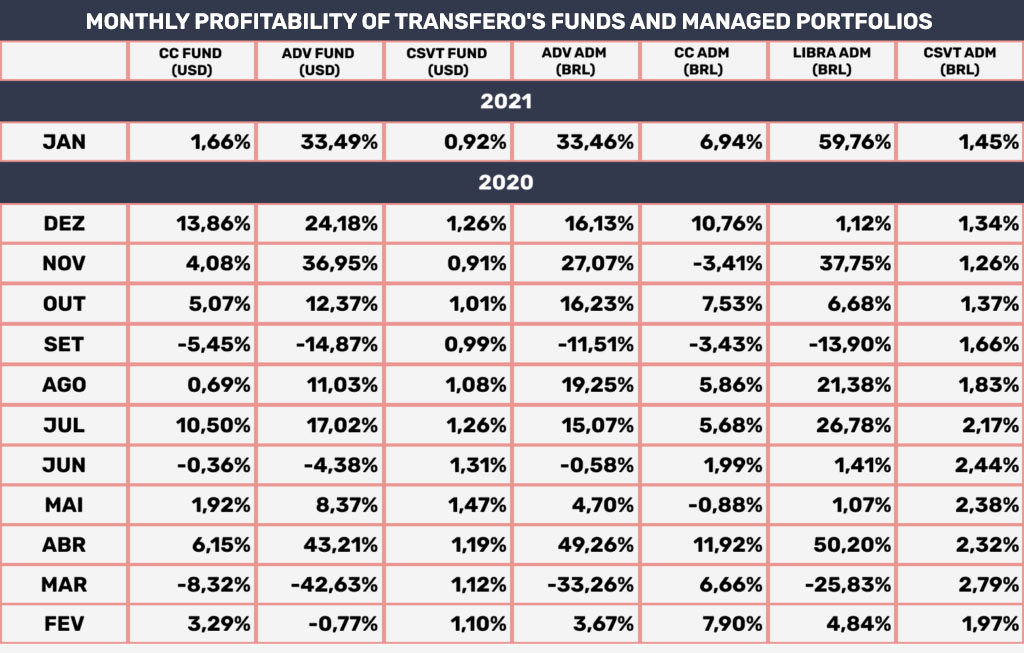

The year 2021 started positively for the cryptocurrency hedge funds and managed portfolios of Transfero Swiss AG. All these products ended January 2021 on favorable ground. The main highlight was the TSAG Libra Top 10 wallet, which yielded 59.76% (in BRL) that month.

This managed portfolio consists of the ten digital assets with the highest market cap. From time to time, assets are redistributed so that the strategy holds 10% participation for each digital asset. TSAG Libra and TSAG Libra Fund are a way to invest in cryptocurrencies keeping up with the market. In addition, it is an alternative to diversify investment to track the value of the largest cryptocurrencies.

Advanced hedge fund seeks profitability in cryptocurrencies higher than that of the market

In the second place, the TSAG Advanced Fund had gains of 33.49% (in USD) in January 2021. The fund and portfolio of the same name seek to identify trends in buying and selling cryptocurrencies. It enables them to identify opportunities for gains

Also, the TSAG Advanced wallet, with yields of 33.46% (in BRL), closes the top three in January, according to the Transfero Report. TSAG Advanced Fund and TSAG Advanced are suited for qualified and professional investors who want to invest in cryptocurrencies. Both seek higher profitability in cryptocurrencies than that of the market.

How to invest in gold and cryptocurrencies with hedge funds

On the other hand, the TSAG Counter Cyclical Fund closed January with a high of 1.66% (in USD) and the TSAG Counter Cyclical portfolio, 6.94% (BRL). The hedge fund’s objective is to expose the investor to assets not correlated to the stock market, with high return expectations. This combination forms the base strategy of this cryptocurrency investment fund. In addition, it is a way to get exposure to cryptocurrencies with reduced risk.

Much is asked about how to invest in gold in the market: TSAG Counter Cyclical is a way to invest in a wallet consisting of gold and bitcoin. Both assets are considered a store of value because they are scarce and therefore protected against the devaluation of national currencies and conducive to protection against the valleys of economic cycles.

Other hedge funds and Transfero wallets

In conclusion, Transfero Swiss’ other cryptocurrency funds and managed wallets also closed higher. First, the TSAG Conservative Fund closed on a high of 0.92% (in USD), and then, the TSAG Conservative portfolio, on a high of 1.45% (in BRL). Conservative funds and wallets work to seek out bitcoin price asymmetries between countries and exchanges. At the same time, they can allocate part of their capital to quantitative strategies.

How cryptocurrency hedge funds work

Transfero’s cryptocurrency investment funds are aimed at institutional clients and professional investors. For example, they are an alternative for pension funds that cannot have direct custody of crypto assets. In addition, they include high-income and high net worth individuals—finally, legal investors, such as other funds and family offices.

As cryptoassets are not yet recognized as a financial asset in Brazil, the assets manager chose the Bahamas to host its cryptocurrency funds. Existing Brazilian cryptocurrency investment funds to date are feeder funds or fund funds. That is, they are investment funds that invest in other international funds exposed to cryptocurrencies.