For the IMF, cryptoassets such as bitcoin no longer mean a refuge in the face of some economic instability in the financial market, and show increased adoption by institutional investors.

“Amid increased adoption, the correlation of cryptoassets with traditional holdings, such as equities, has increased significantly, which limits their perceived risk diversification benefits and increases the risk of contagion in financial markets”.

Over the past two years, the correlation between cryptoassets and the stock market has increased worryingly. According to a warning recently published by the International Monetary Fund (IMF), digital currencies are “no longer on the sidelines of the financial system”.

IMF research reveals a higher correlation between 2020 and 2021

The research was published on January 11, 2022, and signals that the correlation between cryptoassets and the stock market was accentuated during the pandemic as users sought investment diversification.

“Before the pandemic, cryptoassets like Bitcoin and Ether had little correlation with major stock indexes. They were intended to help diversify risk and act as a hedge against swings in other asset classes”.

From “obscure asset class” to “digital asset revolution”, the IMF study highlighted the growth of the crypto market, even as correlation with equities increased.

“Cryptoassets like Bitcoin have matured from an obscure asset class with few users to an integral part of the digital asset revolution, raising financial stability concerns”.

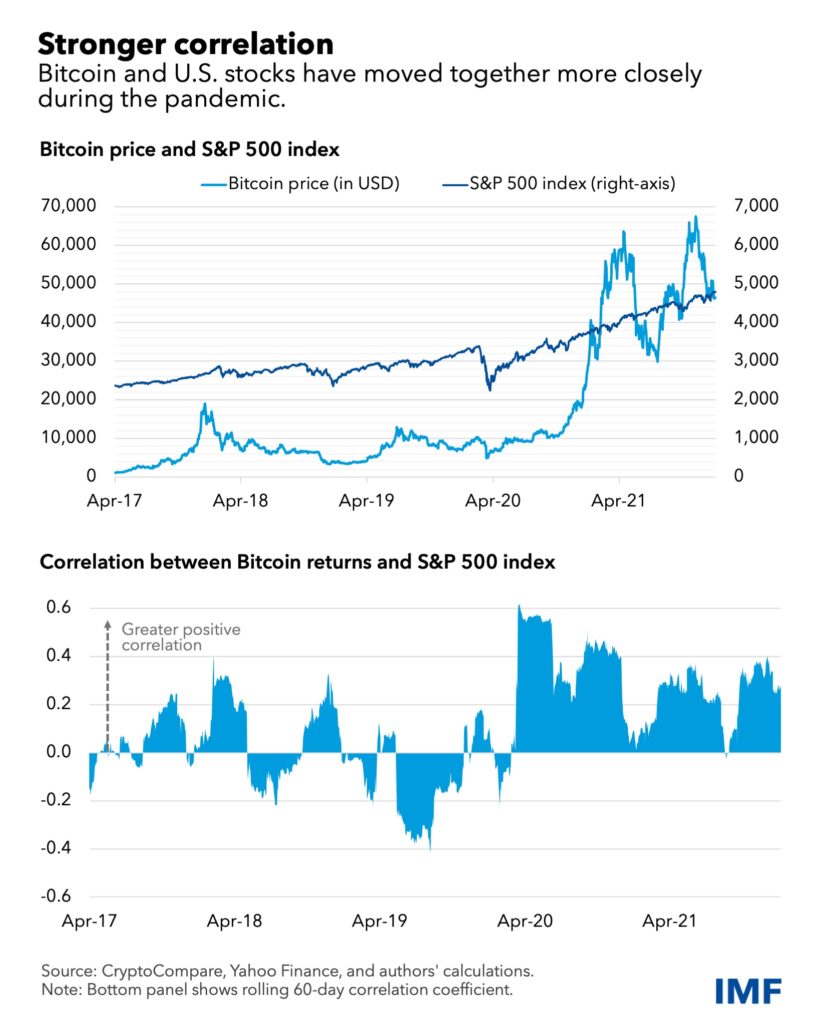

Correlation between bitcoin and stocks increases (Reproduction/IMF)

As the research presents, the price of bitcoin has increased in correlation with the S&P 500 stock index. Between 2017 and 2019, the coefficient of this correlation had values close to 0.01. However, that value jumped to 0.36 between the years 2020 and 2021.

“For example, Bitcoin’s returns did not move in a specific direction with the S&P 500, the benchmark stock index for the United States, in 2017-19. The correlation coefficient of their daily movements was only 0.01, but that measure jumped to 0.36 in 2020-21 as the assets moved more in sync, rising or falling together”.

In addition to the bitcoin correlation with the S&P500 index, the IMF points out that the link between the cryptoasset’s price and the emerging market index (MSCI) has also increased.

With a 17-fold increase in the last two years, bitcoin’s correlation with MSCI reached 0.34 between 2020 and 2021 in the market.