There are many challenges to creating a company in Brazil: taxes and the relentless race for working capital. When it comes to a small importing business, the difficulties are even greater. Nevertheless, the Brazilian entrepreneur, Lucas Heringer, found in BRZ and DeFi an opportunity to transform his business into a web 3.0 company.

Since last year, Heringer has been using BRZ from Transfero, and the Jarvis protocol, which is part of the Polygon network ecosystem, to make his business viable. From stablecoins and different protocols in DeFi, he imports products from China, sells online in Brazil, and keeps the company’s capital ticking.

“DeFi is like a lego: you can assemble and customize it. You can make infinite combinations; the one I made was the best for my business,” he comments.

Read on to understand how it is possible to use the BRZ in DeFi in this success case!

The steps for the web 3.0 company

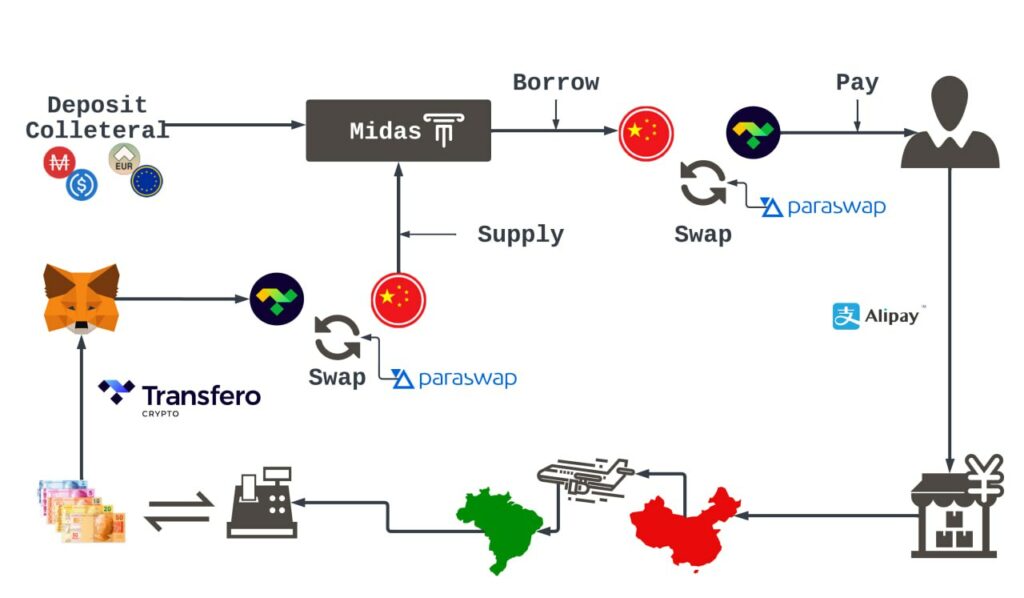

Lucas’ business, a digital tobacco products store, gets its start from BRZ and Midas, a lending protocol in DeFi that relies on crypto assets collateral.

Today I'll share with you how I'm financing my business combining a variety of protocols such as @Jarvis_Network @MidasCapitalxyz @paraswap and @transferogroup

1/16🧵

— Anonymous Trader (@AnonTr4der) January 8, 2023

Lucas uses stablecoin as collateral, as he can deposit through Pix via Transfero Crypto and convert it into BRZ.

“I transfer BRZ to my wallet in Metamask and activate the lending protocol. Then, when I make the deposit in Midas, it opens a letter of credit,” says Lucas.

From that moment on, the BRZ already pays off for Lucas. And that’s how he started his digital business after a year of working in a bakery, by converting part of his salary into BRZ and USDC (stablecoin pegged to the dollar).

And each of these assets has a “Loan to Value,” which represents the percentage that can be converted into a loan. An LTV of 70%, for example, means that a R$ 1.000 deposit can generate a loan of up to 7% of that amount.

When the deposits started to pay off, Lucas realized there was an opportunity to get loans and create his company. The initial BRZ stays in pools that can be used to borrow money for his own business and for him to lend to others.

“DeFi protocols work like a digital broker system but provide very low-interest loans,” says Heringer. Lucas created a way to make loans in a Chinese stablecoin using BRZ as collateral.

The next step in the business is getting the money to the suppliers. And that’s where Polygon comes in.

China and Synthetic Yuhan

Lucas discovered at Polygon a stablecoin called jCNY, a synthetic stablecoin based on yuan, China’s official currency, present in the Jarvis protocol. When Transfero announced the partnership with Polygon, exchanging BRZs for jCNYs to access the Chinese market became even easier.

Lucas relies on a trading partner in China to make the imports for his digital tobacco products store. This partner pays the supplier through Alipay, which avoids exchange surcharges.

In Brazil, most brokers exchange the real for the dollar and then convert it to yuan, which makes the transaction even more expensive for small entrepreneurs.

Next, the supplier sends the products from China to Brazil, and then Heringer places the products on marketplaces such as Amazon and Mercado Livre.

“As soon as I sell the products, I collect the money, deposit it in Transfero, and everything becomes BRZ automatically, with no taxes. Then I send it to Metamask and transform it into jCNY,” he says.

Swaps between BRZ and jCNY are done using another DeFi protocol: paraswap. The system charges a fee of US$0,15 per transaction. Another benefit is that the entrepreneur can use the day’s exchange rates to make purchases.

Advantageous fees

In a short time, the strategy has already generated results for Lucas.

“I’ve had the loan for four months, which generated 50 cent fees in that time. I haven’t even sold all the products, and I’m almost paying off my loans,” he comments.

At Jarvis, Lucas benefits by paying very low for loans. According to Lucas’ calculations, his business will pay R$ 1,10 in fees related to exchange and transactions in a year.

This is only possible because the entrepreneur uses both aspects of DeFi: he lends jCNY and BRZ and makes loans of these same stablecoins. According to the entrepreneur, DeFi allows him to hedge against his own purchase.

More time and ease

More than gaining from lower fees, Lucas says he has gained a lot in time and productivity.

“I have more time to work. That means I’m not in a rush to sell. Instead, I can work on my brand, spending more time developing it. It gives me time to think about how I will work and how to sell a product. And even to figure out which products sell best and what my next products consignments will be,” he says.

In other words, the stablecoin used together with the protocols in DeFi has made Lucas’ business a “smart-company”, one that uses money more efficiently, with fewer losses and out-of-plan spending.

Now he wants to teach more entrepreneurs the fast track to the top.

“Many Brazilians don’t know about it, even though Brazilians are one of the biggest investors in crypto. I want to teach people how to use decentralized protocols to invest in a dream of their own,” he says.

Lucas is on Twitter (@Cryptoclubeth) to talk about the subject. In addition, the entrepreneur teaches classes every Wednesday at 7:30 pm on the Metadex community on Discord.

“I explain everything about DeFi and quite a bit about how BRZ works. I teach about some issues on security because I want people to learn and invest using BRZ from now on,” he concludes.

Besides making it possible to build a digital business, the protocols in DeFi and the benefits of BRZ allow for other gains. In the case of Balancer, for example, it is possible to have stablecoin earnings just by providing liquidity to a pool.