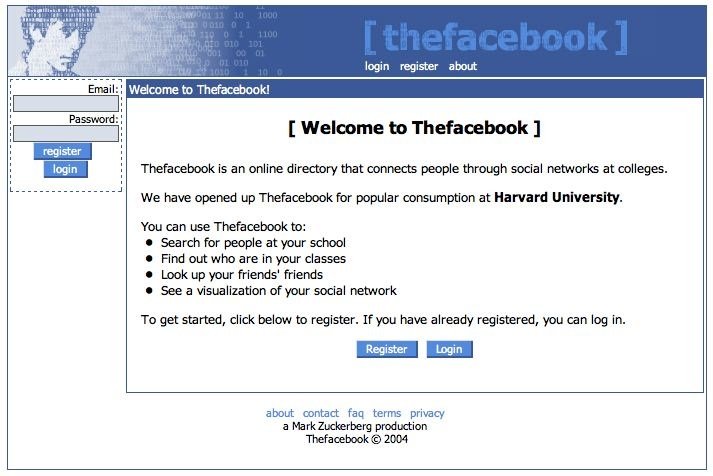

Imagine if in 2004 you were given the chance to invest in the newly established Facebook business. That is to say, before any IPO process, or even daring to imagine that the company would become what it is today. You could have bet your money in the project buying a small portion of it. And today, 15 years later, you would surely be rich. Now convert this investment view into the world of digital assets, or more specifically to the bitcoin. The bitcoins were created in response to the widespread distrust in the international financial system after the sub-prime crisis in 2008, and the asset was developed to be a digital currency that would allow transactions without intermediaries and with very low costs.

Well, the rest is history. Those who joined the market in the beginning, have been witnessing their assets multiplied compared to fiat money such as dollar. In 2013, according to the latest data released by CoinMarketCap, the bitcoin was traded at US$ 134.21. Today, six years later, a unit of currency exceeds US$ 8000. That is, almost 60 times more.

Why the bitcoin is more than an investment

However, the bitcoin is much more than an asset for speculation. Its creation gave power to people over the banks, which until then held a monopoly on financial transactions. As a consequence, people around the world had access to a tool that empowers them in face of an increasingly digital economy.

Along with the bitcoin, came the blockchain and (today) thousands of tokens. Although these currencies can also be used as a speculative asset, each of them has an application in real life. For example, the Ethereum, is a decentralized platform capable of running smart contracts and other structures using the same bockchain technology. On the other hand the IOTA, is a project with its own structure, Tangle, and that purports to be a transaction layer of the internet of things. In other words, it will give humans and machines the possibility to participate in an emerging economy of devices and object in general connected to the internet.

Investing in a digital asset is betting on something you believe in. Whether is it in financial terms, technological, or even ideological.

Juliana Walenkamp, Business Development at Transfero Swiss AG

These are just two examples. Other tokens are designed to solve other problems, such as international transactions, technological development, supply chain traceability, KYC, and much more. In other words, investing in a digital asset is betting on something you believe in. Whether is it in financial terms, technological, or even ideological.

Recognize the blockchain as a revolution similar to the internet

Therefore, the blockchain is a revolution similar to the invention of the internet. The World Wide Web approached countries and people, and made the knowledge available to everyone, in addition to making every human being on the planet a producer of knowledge. But no one has thought in the financial market. The blockchain came to fill that gap and give citizens new possibilities that the internet itself had not yet given.

It is important to remember that investing in a project of blockchain – and consequently in a digital asset – is in fact a risky investment. In most scenarios those are companies that need resources to develop and are exposed to the possibility of simply not surviving. This is why it is important to be well informed about the token that you are buying. And as a risky investment, it´s important to be careful not to employ a portion of your assets that can keep you awake at night.

Investment in bitcoin in a rational and sound way

To this end, the Transfero Swiss AG helps investors to enter the crypto market in a rational manner, knowing the risks and possibilities of return inherent in it. The company is an expert in investment management and each day is developing soundly rooted as a gateway for investors who have empathy for this market, not only by the financial possibilities, but also for the revolution it represents in the globally financial and technological market.