Aware of the cryptocurrency technology, central banks around the world are developing – or planning to develop – their own digital currencies, the so-called CDBCs. A survey by Bank of International Settlements (BIS), based in Switzerland, listened to 66 central banks around the world and found that 80% of them are at some stage of developing these instruments.

According to the research, the purposes are both for general use and for wholesale use. Of the total number of banks, 40% advanced from the conceptual phase to experiments. Among those is the People’s Bank of China, which plans to launch its own digital currency later this year.

In January, the Bank of Canada, the Bank of England, the Bank of Japan, Sveriges Riksbank (Sweden) and the Swiss National Bank, together with the European Central Bank and the BIS, announced that they had formed a group to assess CBDCs opportunities in their home jurisdictions. The group will also evaluate economic, functional and technical design options, including international interoperability and knowledge sharing on emerging technologies. The BIS even encourages central banks to have their own digital currency.

Here’s a little more about ongoing projects:

Central Bank of England discusses issuing its own digital currency

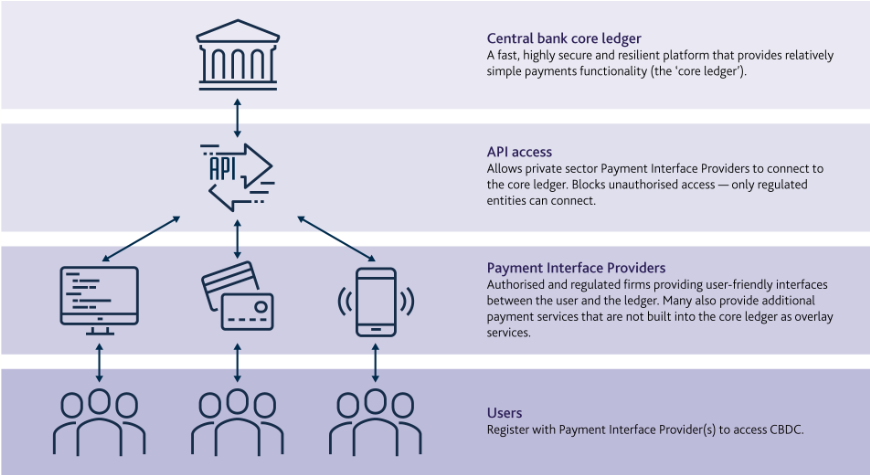

The Bank of England released a discussion paper on a CBDC in March this year. The bank has not yet made a decision on the introduction of this instrument. It also intends to assess the benefits, risks and practical aspects. See below the proposed model:

Bank of Japan foresees private initiative for national currency

In addition to the joint initiative mentioned above, Bank of Japan foresees a joint initiative of private banks to launch a national cryptocurrency in the country. The project is being handled by Mizuho Bank, MUFG Bank and Sumitomo Mitsui Banking Corporation, in partnership with exchange DeCurret. Non-financial entities such as telecommunications giant NTT Group and East Japan Railway Company, which manages the popular Suica smart transit card, also participate. The Bank of Japan (BoJ), the Financial Services Agency and several government ministries will participate as observers.

Bank of Canada wants to protect user privacy

After years of research, the Bank of Canada is preparing to develop a CDBC. In a recent work publication, the bank reported that Canada’s CBDC must protect user privacy, be accessible to those who don’t have bank accounts or cell phones, run even without power, and rival with the bills regarding safety issues. Despite this, the bank is not yet committed to this development.

Sveriges Riksbank (Bank of Sweden) tests different models

The Sveriges RiksbankThense studies different models for the emission of e-krona. One of them, fully centralized, would have greater resiliency, as it would function as a different platform, directly handling customers. However, this model would imply a completely new role for the Riksbank, much like a Commercial Bank. Thus, it would take large investments in infrastructure and personnel to maintain accounts for millions of users. It could also be implemented in a reduced version for specific user groups as a complement to existing solutions provided by the private market.

Another approach would be a synthetic e-krona, relatively easy to implement and would cost less than the other alternatives. However, this approach may not achieve the goals of greater competition and resilience to the same extent, as it would be quite similar to today’s system. Furthermore, it would not be a direct claim from the Riksbank and therefore it is unclear whether this really should be considered a CBDC.

Swiss central bank wants a pure digital currency

The Swiss Central Bank (SNB) wants to develop a pure digital currency in order to make the most of the technology. However, another initiative is more likely to take the lead. In October 2019, the SNB partnered with the SIX stock exchange to work on a proof of concept for a digital currency. SIX is also working on its own digital hub, called the Swiss Digital Exchange (SDX), which will be launched later this year.

The idea is that the stablecoin should be issued by SDX, which would keep Swiss francs in a bank account as collateral. Any token buyers can withdrawal them individually for Swiss francs with the company. But they could not do it with the Swiss central bank or any other company.

China begins pilot project with e-yuan

After more than five years of development, China has launched a pilot project for its own digital currency, the e-yuan. The idea is that the digital currency gradually replaces cash money. The move is seen as an attempt by China to challenge the dollar as a global currency reserve value. The Chinese, in turn, are already accustomed to digital payments and the adoption of the currency would be relatively smooth.

The People’s Bank of China (PBOC) has launched the first tests in four Chinese cities – Shenzhen, Suzhou, Chengdu and the new Xiong’an area near Beijing. Initially, the currency would be used to pay transportation tariffs in Suzhou and would focus primarily on food and retail services in Xiong’an.