The third bitcoin halving took place this Monday (11/05) at 19:23 (GMT), when block 629999 of the bitcoin blockchain was mined. At the time of halving, the price of bitcoin was at the level of $ 8,500, with the asset registering a dominance of 67% over other crypto. The equation that results in the closing of the block before halving was solved by the mining company F2pool. In all, the block registered 2,481 transactions, for a total of 11,357.69 BTC – or approximately US $ 96.5 million in the halving moment.

From block 630,000 the reward paid to miners for resolving a block drops by half, from 12.5 BTC, to 6.25 BTC. That is, until the next halving, the issuance of new bitcoins is 50% lower than at the moment before the third halving. The next halving is estimated to take place in four years, or more precisely, 1,384 days from today.

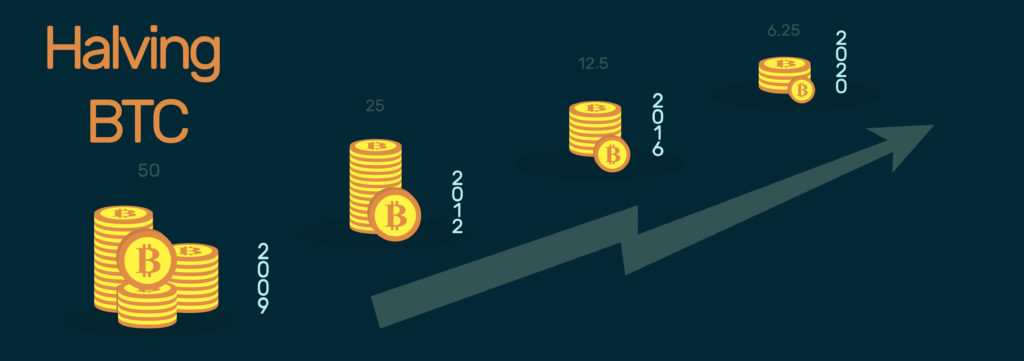

Since the first bitcoin block was generated in 2009, there have been three halvings. They occur every time 210,000 blocks are generated, or approximately once every four years, as defined in the bitcoin algorithm. The first halving took place in 2012, reducing the block’s original reward from 50 BTC to 25 BTC. The second was in 2016, with the reward dropping from 25 to 12.5 BTC.

Halvings are expected to continue until 2140, when the last of the 21 million bitcoins will be generated – there will be a total of 32 halving events. At this point, the reward for each block generated should be 1 satoshi (0.00000001 BTC), the smallest bitcoin unit. At the time of publication, the number of bitcoin in circulation was 18.37 million, according to Blockchain.com.

Third bitcoin halving is in Transfero’s special thesis

Halving is seen by the market as an important price trigger for cryptocurrency. In 2012 halving, the price of cryptocurrency went from $ 10 to reach the $ 1,000 threshold. In the next halving, bitcoin went up to $ 17,000, to stabilize in the $ 10,000 range. As of now, bitcoin tends to make the move to seek the $ 100,000 threshold, according to the stock-to-flow mathematical model.

Bitcoin halving is even one of the pillars of Transfero Swiss’s special thesis that crypto assets will be the best performing assets in the next two years. And according to the head of Research and Portfolio Management at Transfero Swiss, Carlos Russo, it had not yet been priced by the market.