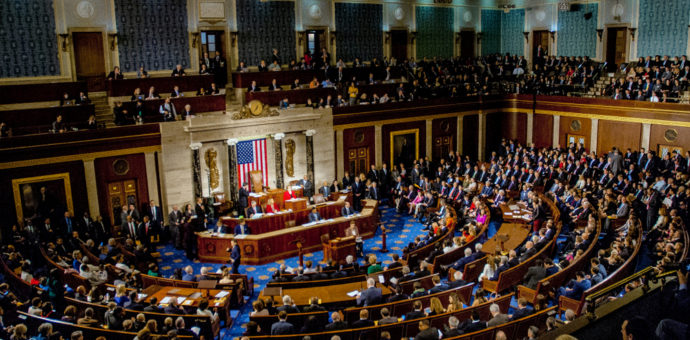

Voted on by the US Senate on March 6, the stimulus package that will inject US$ 1.9 trillion into the economy may be an immediate relief for citizens and local governments at first. However, in the long term, there is a risk of dollar devaluation.

After all, more money in the market does not necessarily mean that consumption will increase to the same extent. With the extension of the crisis resulting from Covid-19, consumers are fearful and insecure about the future.

Therefore, the interventions made by Central Banks (not only in the US, but all over the world), although they can bring immediate liquidity, calming investors, do not necessarily reduce the economic crisis.

Injection of resources will be the third since the beginning of the pandemic

The package approved by the U.S. Senate will still need to go through a vote in the House of Representatives before presidential approval. In any case, if the funds are actually injected, it will be the third one approved by Congress since the pandemic began a year ago.

The initiative includes direct payments of US$ 1,400.00 to taxpayers with incomes under US$ 80,000.00 annually, plus funds for local and state governments, vaccine purchases, and school reopenings.

Besides, the package provides US$ 415 billion to boost coronavirus response and Covid-19 vaccination, about US$ 1 trillion for direct relief to families, and approximately US$ 440 billion for small businesses and communities particularly hard hit by the pandemic.

Cryptoassets are an alternative to protect the capital from the devaluation of the dollar

The reflection of dollars injection into the market is their devaluation against other currencies. In 2020, the year when more dollars were issued, their value fell against the world’s leading currencies (with a few exceptions, such as the Brazilian real).

According to the Bloomberg Dollar Index (BBDXY), an index that measures the dollar’s performance against a basket of global currencies, including emerging countries, the decrease was more than 12% last year.

Such depreciation represents an opportunity for the cryptocurrency market since such assets are based on programmed scarcity. Just as gold has a natural limit, it is a finite resource. As economic scenarios worldwide point to a prolonged period of recession, investing your funds in cryptoassets may be the best strategy to protect them from devaluation.