Institutional investors are increasingly getting interested in bitcoin. A recent fall in the cryptocurrency price has increased the interest in regulated crypto derivatives in the U.S. market. Increased demand was read by the market as a clear sign of an enhancement in interest from institutional investors in bitcoin.

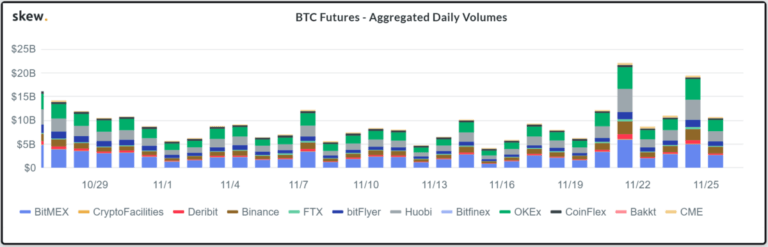

The demand recorded at Bakkt at the end of November was a proof of this movement. In that period, with the fall in the bitcoin price, the stock market reached a new historical record in traded volume. In all, 2,728 monthly BTC futures contracts were traded in one day, equivalent to more than US$ 20.3 million. A similar phenomenon has occurred in the CME.

Institutional investors investing in bitcoin

This is not the only indication of the increased interest of institutional investors in bitcoin. In one of its quarterly reports, Grayscale registered a US$ 171.7 million entry into institutional capital at the Bitcoin Trust. According to the company, this is the quarterly “heavier” entry in the six-year history of the product.

Due to the growing demand from qualified investors, the company filed a voluntary registration statement on Form 10 at the U.S. Securities and Exchange Commission (SEC) on behalf of its Bitcoin Trust.

If approved, the investment fund will be regulated by the SEC, offering more safety to institutional investors. And it would become the first investment tool in encrypted digital assets to achieve it.

If institutional investors are increasing their interest in bitcoin, the same cannot be said of retail investors. The number of addresses with balances greater than or equal to 0.1 BTC fell significantly in October.

These elements show that the institutional investment in bitcoin is maturing. Investment funds, for example, are adding crypto to their wallets. In addition to them, pension funds are also putting a percentage of their assets into cryptocurrencies.